Financing at the point of sale (Invoice or payment request)

Your customers do not have to prequalify in order to apply for financing. They can simply click the financing button on the checkout page, after receiving an invoice or payment request.

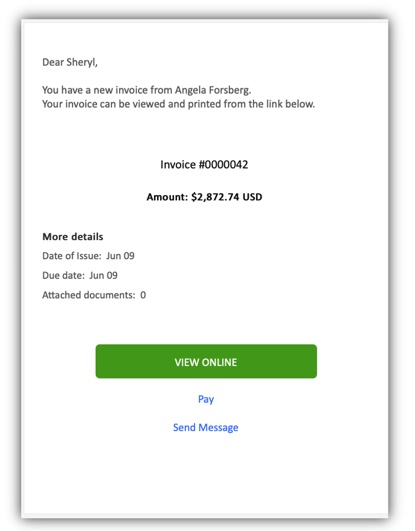

Step 1: Once services are complete, send your customer an invoice or a payment request for the full service amount.

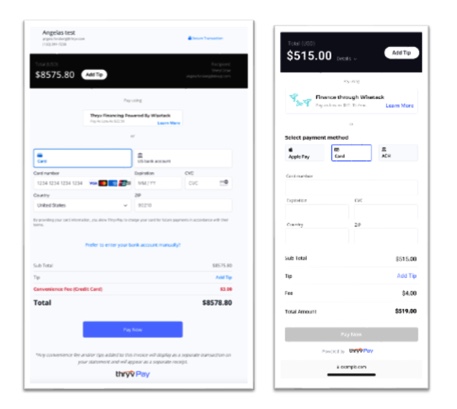

Step 2: Your customer can choose one of many options to pay you, but if they choose to finance, they will select the “Financing with Wisetack” financing box at the top of their checkout page. They will then be taken to the loan application. They simply fill out their information, click submit, and then will receive approval status within minutes.

- The customer can only be approved up to the amount of the invoice.

- Your customer can not finance more than the final invoice amount.

- If your customer was only qualified for a partial amount, they would need to pay the remainder of the invoice with a different payment method.

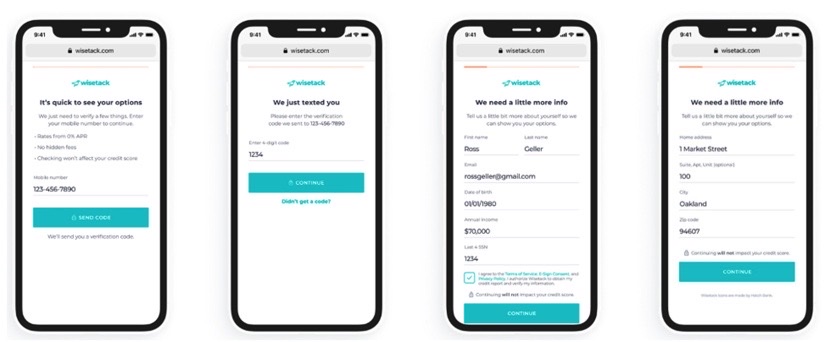

Step 3: Your customer will fill out the application details.

Starting with phone number verification

Application details (this step is skipped if the customer is already prequalified)

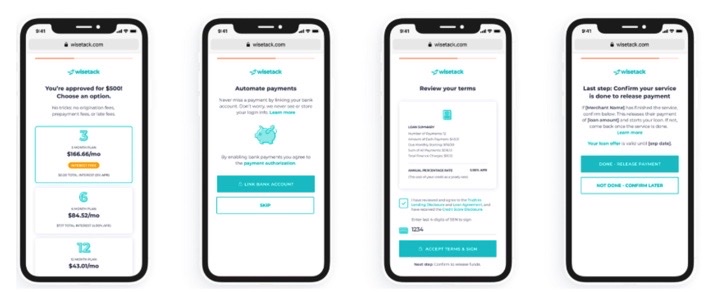

Customer will then selecting the loan terms they wish to approve

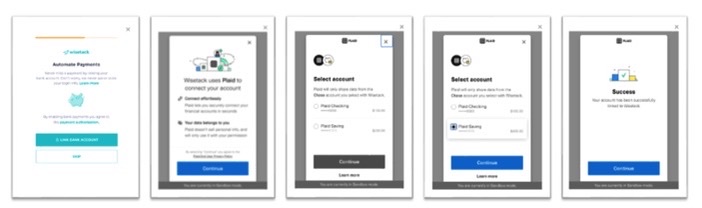

Customer will connect their bank account for automatic payments

Customer connects their bank account via Plaid and selects their loan term

Loan term and details are verified and the customer accepts the terms and conditions!

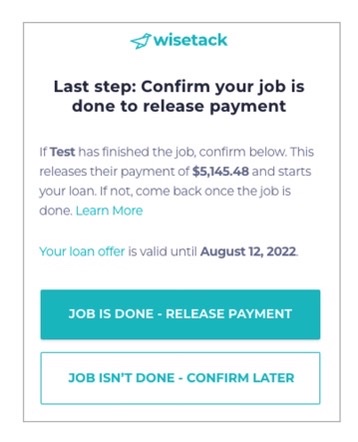

Step 4: IMPORTANT Your customer is required to “confirm” the loan prior to payment being made. We recommend that you do not leave the premises or the phone call until you get confirmation that the loan is confirmed by the customer.

THIS IS THE MOST IMPORTANT STEP: PLEASE READ CAREFULLY

Your customer MUST click the “JOB IS DONE - RELEASE PAYMENT” button

This is what releases your funds! We recommend you do not leave the premises or get off the call before the customer completes this step, or it could delay your deposit!

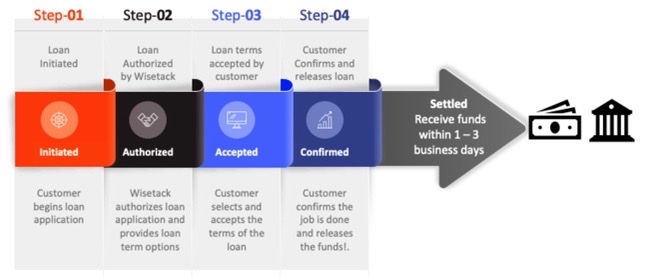

Loan Application Timeline

Step 5: You will receive your funds within 1 to 3 business days after the customer accepts and releases the loan payment.

IMPORTANT NOTES:

- Your invoice will remain “unpaid” or past due until the customer confirms the loan.

- Once the loan is confirmed the invoice will move to a “paid’ status

- Once the invoice is “paid”, your deposit will show as “pending” until it has been settled

- Once the loan “settles” the loan transaction amount minus fees will show as “deposited” on both the transactions tab and the deposit tab.

Comments

0 comments