Disputed transactions may happen from time to time. This article will provide you with the information you'll need to help prevent disputes from coming in and challenge a dispute with your customers issuing bank after a chargeback occurs.

Note: This guide only refers to charges processed through ThryvPay. If you receive a chargeback on a payment made through another payment gateway, you will need to contact them directly for their process.

What is a chargeback?

A chargeback is a disputed transaction initiated by a consumer to their issuing credit card bank. Essentially the consumer is requesting their money back and is disputing the charge with their issuing bank instead of with the merchant (in this case, you) directly. This could be because the consumer has already tried to receive a refund or dispute the transaction directly with the merchant and they didn’t receive the result they wanted, or they didn’t realize they could go directly to the merchant to try and solve the issue prior to disputing the transaction.

What are the common reasons you might receive a dispute or chargeback?

- Disputes – Non fraudulent

- Customer is stating goods/services were not received.

- Customer is stating goods/services were not as described.

- Customer is stating they canceled the transaction prior to delivery.

- Customer doesn’t recognize the transaction or your business name on their credit card or bank statement.

- The customer contacted you to receive a refund and was denied.

- The customer didn’t realize they could go directly to you to try and resolve the issue prior to disputing the transaction with their bank/card provider.

- Disputes - Fraudulent

- Customers account was hacked.

- Customer is saying someone else purchased the goods/services without permission.

- Customer is trying to get their money back even though you provided the goods and services as expected.

Note: When funds are withdrawn due to a chargeback, they are withdrawn by the issuing bank (the consumer's bank). Neither your bank nor ThryvPay has access to the funds to release them to your account.

How will you be notified of a chargeback?

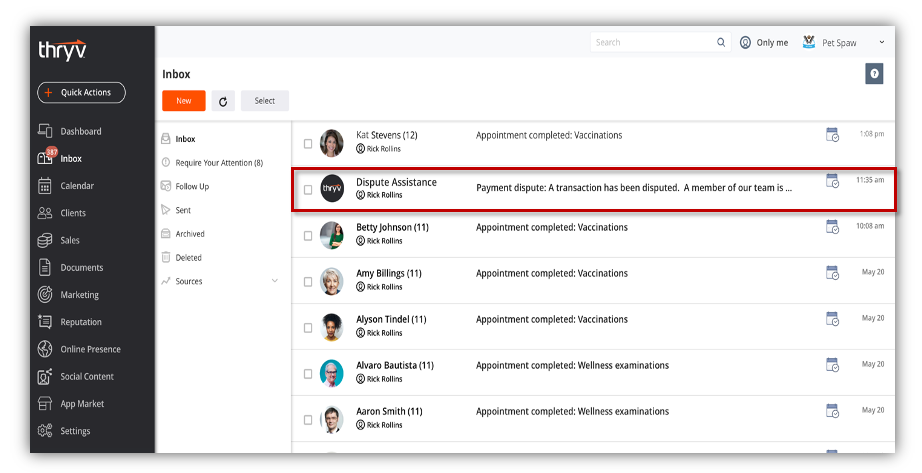

- You will receive an inbox notification in your Thryv

-

The ThryvPay Support team will reach out to you to determine if you wish to accept or fight the chargeback, and to request any documentation you may have that supports your fight.

What are your options for resolving a chargeback?

- You can accept the dispute and the chargeback, essentially agreeing to the refund.

- If you have a good relationship with the consumer you can try to reach out directly to ask what the issue is. If you both agree the charge is valid and the merchant is entitled to the payment, ask the customer to cancel the chargeback with their bank.

- If you both agree the charge is invalid and the customer is entitled to a refund, you can accept the chargeback

- You can also challenge or fight the chargeback. Fighting the chargeback will not suspend any refund as that happens automatically from the issuing bank. You receive your funds in the event the dispute is resolved in your favor.

- If you both cannot agree, but you still feel like the charge is valid, fight the dispute and supply your supporting documentation. Supporting documentation can be signed contracts, communication like emails or text messages with the client, pictures of the job site, shipping and tracking information, or any other specifics you can find.

Support for Chargebacks

What type of chargeback assistance does ThryvPay include?

We provide chargeback assistance when you use your Thryv software to document and book appointments, client data, communications, documents, and payments.

This is how the chargeback process will work when you use your Thryv software:

- You will receive an inbox message notifying you of the dispute.

- ThryvPay Support will also contact you directly to gather additional details to help fight your dispute.

- ThryvPay Support will help you gather documentation on the transaction from your Thryv account, this can include any estimates, invoices, conversations, previous payment history etc.

- ThryvPay Support will submit the dispute details on your behalf to your customer’s bank.

- You can either choose to accept the dispute and not fight it or fight the dispute and provide documentation to support your transaction.

- The bank is 100% responsible for any refunds/chargebacks that happen regarding a dispute, and they will keep the funds until a decision is made.

- We will submit all of your information to the bank, but ultimately the bank makes the final decision on who will win the dispute

Important Note: ThryvPay Support will not have the ability to provide chargeback assistance if you don’t use your Thryv software to document and book appointments, client data, communications, documents, and payments.

This is how the chargeback process will work if you don’t use Thryv software:

- ThryvPay Support will reach out to you to ensure you are aware of the dispute

- They will provide you with a guide to follow on what types of documentation you will need and directions on how to upload your documentation

- You will gather any supporting evidence about the transaction and provide it to ThryvPay Support via email @ thryvpayescalations@thryv.com.

- ThryvPay Support will submit the documentation on your behalf.

What are some ways you can help prevent chargebacks?

- Consumer Chargebacks

-

Customer Complaints

- Answer and return customer calls and emails in a timely manner

- Save shipping and delivery details.

- Take before and after pictures.

- Store all communication with the client.

- Record signatures on contracts when necessary.

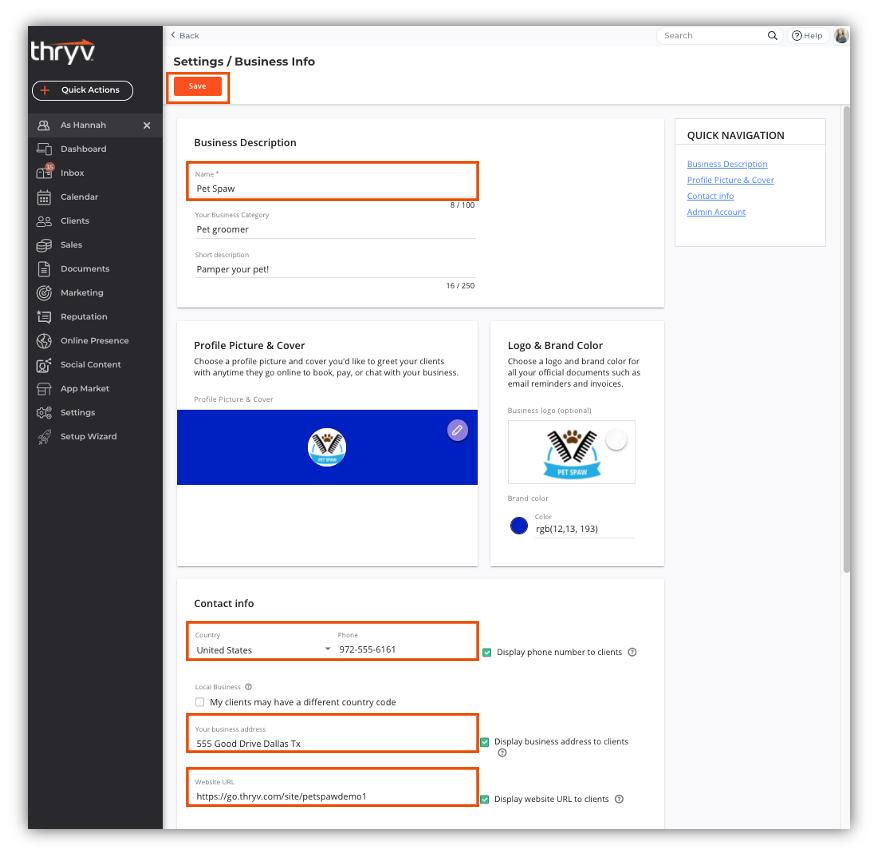

- Make sure your business name, phone number, address, and website display on your receipts.

- Log into your Thryv account

- Click on Settings

- Ensure the following are updated:

- Business Name

- Phone Number

- Business Address

- Website URL

- Select Save

-

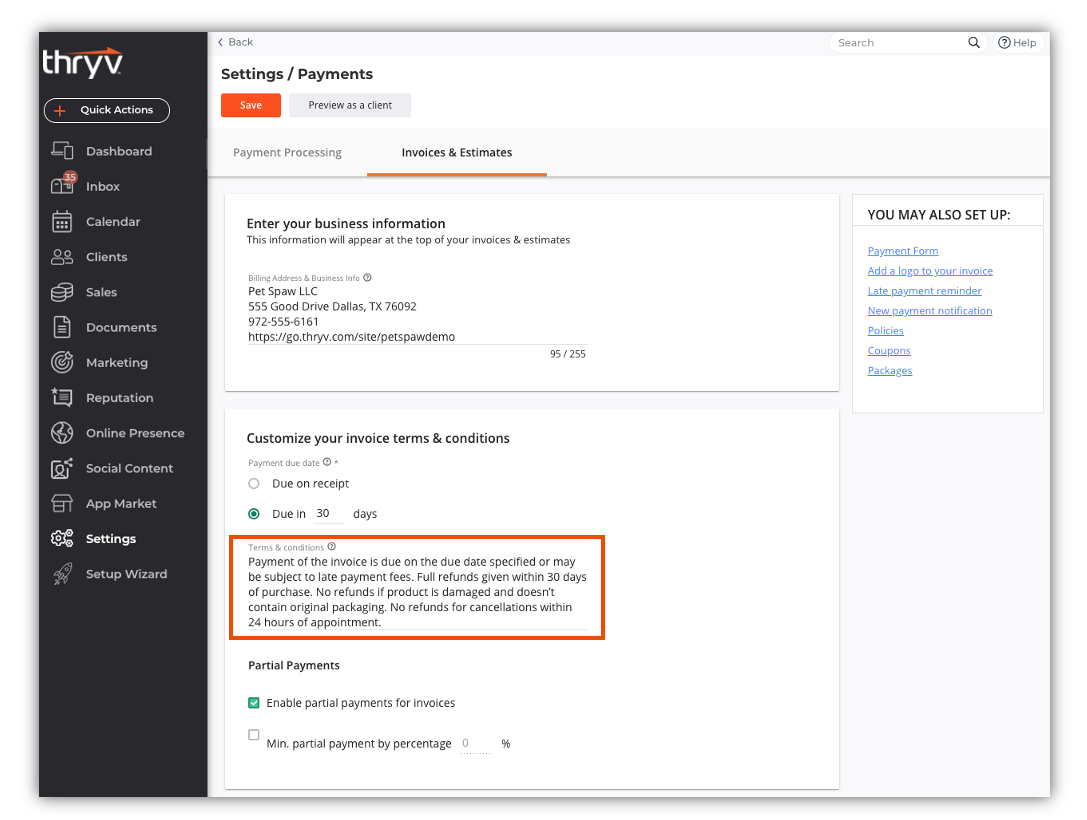

- Be sure to update terms and conditions stating your refund policy within your Thryv software

-

- To update Terms and Conditions policy perform the following steps:

- Log into your Thryv account

- Select Settings > Payments > Invoices & Estimates tab

- Input Terms and Conditions

- Try to set clear policy expectations before payment is made

o EX: Full refunds given within 30 days of purchase

o EX: No refunds if product is damaged and doesn’t contain original packaging

o EX: No refunds for cancellations within 24 hours of appointment

- To update Terms and Conditions policy perform the following steps:

-

- Notify consumers of any delay in services or goods delivered

- When creating or updating your client card within Thryv, collect as much information as possible:

- Consumers Full name

- Consumers Email address

- Billing address, Zip Code

- Shipping address, Zip Code if different

- Phone#

- Fraud Chargebacks

- For in-person transactions compare the consumers name on their credit card with their driver’s license

- Risky transactions can be flagged due to the following:

- Purchase amount is significantly greater than your average transaction amount

- International credit card is being used

Are there different types of dispute statuses?

Yes, a dispute / chargeback, can appear as a request for retrieval, or as a dispute with a chargeback.

- Request for Retrieval – AMEX only

- American Express may send a request for retrieval prior to a full dispute.

- A request for retrieval does not automatically refund the transaction to your customer. Amex waits to see if you challenge the dispute and provide information or not.

- You can choose to accept the dispute and refund the transaction.

- If you provide information and they agree in your favor, the dispute will be canceled, and no refund will be given to your customer.

- You can choose to fight the dispute.

- If you don’t provide information or they go in favor of their customer, a formal dispute will be initiated, and a chargeback will incur, and the dispute will be closed in your customer’s favor.

- You’ll be asked to submit documentation proving the transaction was legitimate, there was customer approval or that the goods were delivered as expected.

- The customer’s bank will review the documentation submitted and will make the determination on whether the transaction should be fully disputed or if they will side with you and close the request in your favor.

- All disputes incur a $20.00 fee regardless of the outcome.

- Dispute and Chargeback – VISA, Mastercard, Discover and others.

- The customers bank receives a dispute from their customer.

- The customers bank will immediately chargeback (refund) your customers transaction amount.

- You can choose to accept the dispute and choose not to fight it.

- In this case the funds will remain refunded back to the customer

- You can choose to fight the dispute

- You’ll be asked to submit documentation proving the transaction was legitimate, there was customer approval or that the goods were delivered as expected.

- The customers bank reviews the documentation provided and determines if the transaction is legitimate or not and ultimately decides who wins or loses the dispute.

- If the bank sides in their customers favor, the transaction will remain refunded.

- If the bank sides in your favor, you will receive the funds back within 10 business days typically.

- All disputes incur a $20.00 fee regardless of the outcome.

Comments

0 comments